INSIGHT

Australia, expect two big years of growth

The year 2020 was a stronger one than first forecast, and ANZ Research expects that trend to continue into 2021 as the economy moves from recovery to expansion. Australia’s economy is set to remain strong through the current year, with growth of 4.2 per cent now forecast, and in 2022, which is expected to expand by 2.7 per cent.

With population growth low, this represents two years of well-above-trend growth and will be sufficient to push the unemployment rate down to 5 per cent by the end of 2022.

The speed of the post-COVID recovery continues to surprise, reflecting successful management of the health crisis alongside enormous fiscal and monetary stimulus. ANZ Research now expects GDP to return to pre-COVID levels in the current quarter.

While the labour market outlook has improved, the rate of improvement is likely to be more gradual from this point, with the end of the JobKeeper employment stimulus imminent. ANZ Research expects the unemployment rate to reach 5.8 per cent by the end of 2021 and 5 per cent by the end of 2022. Wage growth is expected to remain tepid.

Considerable uncertainty remains around the outlook, and the recovery continues to be uneven. But as vaccines roll out internationally and domestically, the key area of uncertainty – the pandemic itself – should abate.

The massive fiscal stimulus designed to support incomes through the worst of the crisis is being wound back. Policy focus will likely return to deficit repair as the unemployment rate lowers.

Monetary policy is set to remain very easy, with the cash rate on hold for an extended period. Other aspects of the monetary policy mix, such as the yield curve target, will evolve much earlier however.

Above trend

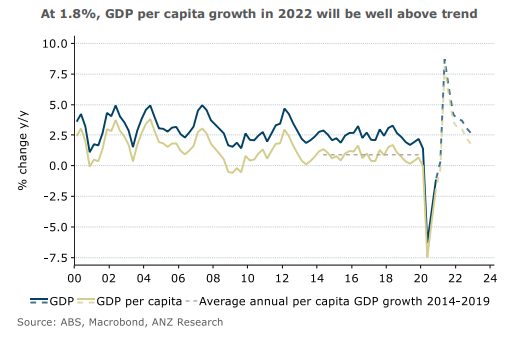

With population growth much lower than usual, ANZ Research’s growth forecasts are much stronger than trend.

The population is expected to grow just 0.5 per cent through 2021 and 0.9 per cent through 2022, leaving forecast per capita GDP growth at 3.6 per cent in 2021 and 1.8 per cent in 2022, well above the average of 0.9 per cent recorded in the five years to 2019.

Strong tailwinds are forecast to help. The Reserve Bank of Australia is expected to keep the cash rate at 0.1 per cent until at least 2024. Measures put in place to support housing and investment will support growth in 2021 and early 2022.

Global growth should be particularly supportive, with massive fiscal stimulus in the US driving strong growth and supporting the global recovery.

All of these factors will provide positive impetus for Australia. By late 2022, some of these tailwinds will be abating. Housing construction and equipment investment are both likely to turn lower in late 2022.

Consumer spending has bounced back strongly as restrictions lift and sentiment improves. Some of the earlier gains in the household saving rate have unwound, although it remains elevated, giving households a buffer as stimulus diminishes. A high level of cash deposits will also support spending.

The housing sector is rebounding sharply, helped by government support as well as low interest rates. Housing finance has picked up strongly. Building approvals rose more than 50 per cent between June and December, before pulling back in January. Bringing forward construction will inevitably create a shortfall of activity once stimulus is withdrawn, so activity is likely to fall in 2022.

Housing prices are being supported by low mortgage rates and the prospect of this continuing for an extended period. APRA is expected step in with macroprudential controls later this year, which will see house price growth slow in 2022.

Business investment has already turned higher, and we expect a solid recovery through 2021 as the federal government’s temporary full expensing scheme lifts spending on machinery and equipment.

Driver

Public demand will be a driver of growth. While federal support is tilted towards stimulating private demand, growth in government spending is likely to remain strong over the next year or so.

Closed international borders will continue to weigh on Australian services exports. The full rollout of a vaccine is likely to take some time, and a relaxation of international border controls seems unlikely until 2022.

Trade tension with China is a risk for the outlook. While ANZ Research has factored in some impact, increased tension is a downside risk for the exports outlook.

The labour market has improved rapidly but there is still a long way to go. The elephant in the room is the end of JobKeeper. But there are some factors that should smooth the transition, and the market is in a much stronger position than expected when JobKeeper was extended back in July.

With JobKeeper ending, ANZ Research expects a temporary rise in the unemployment rate of approximately 0.3 percentage points in the June quarter, but unemployment should resume its downward trajectory in the second half the year.

There is still a high degree of uncertainty around the outlook. The possibility of further upside risk for the labour market cannot be dismissed, particularly given the upside surprises seen since mid-2020.

But there are also downside risks. We may already be seeing a rebalancing between full-time and part-time work, after the full-time employment recovery initially lagged.

Felicity Emmett & Catherine Birch are Senior Economists and Hayden Dimes is an Economist at ANZ

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.