INSIGHT

The New RMB Reality

Download the PDF

Anshul Sidher, Head of Markets Trading and Product, ANZ | January, 2018

________

IN RECENT YEARS GLOBAL MARKETS HAVE CONTINUED TO ADAPT TO THE GROWING ROLE OF CHINA’S ECONOMY AND FINANCIAL SYSTEM. THE NARRATIVE PUT FORWARD BY MANY COMMENTATORS ACROSS THE INTERNATIONAL COMMUNITY IS THAT CHINA MAY EITHER EVENTUALLY UNSEAT THE PRINCIPAL ARCHITECT OF THE GLOBAL FINANCIAL SYSTEM – THE UNITED STATES – OR FULLY CONFORM TO THE SYSTEMS ESTABLISHED OVER THE COURSE OF THE PREVIOUS CENTURY.

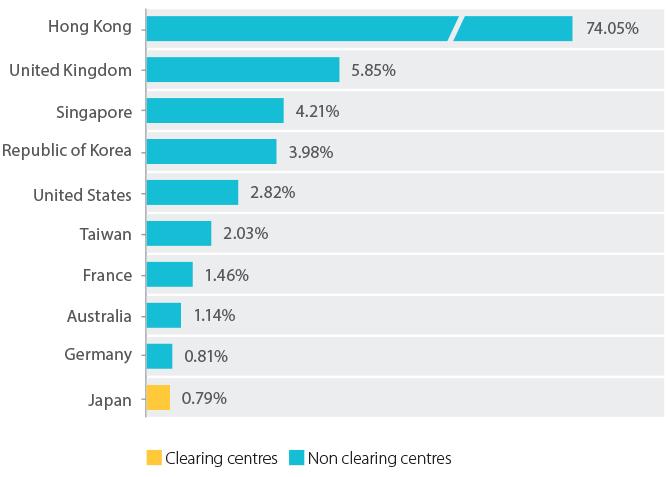

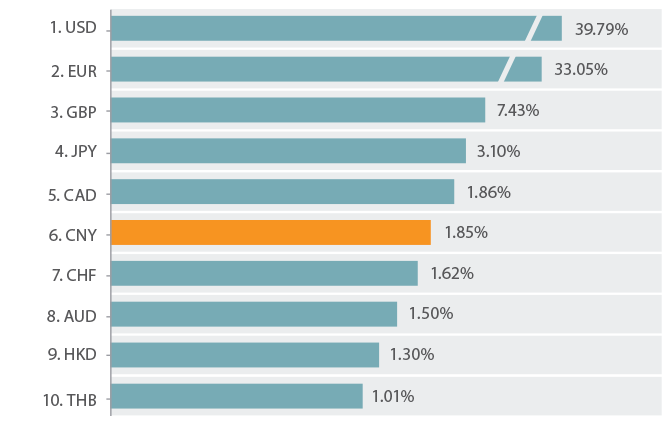

What we are seeing now, however, is that China is in the process of aligning components of the existing global financial architecture with its strategic currency goals overseas and the pace of its market reforms at home. China accounts for nearly 14% of global trade and 40% of the global GDP growth so it is no surprise that the renminbi’s (RMB) position has increased from #14 in December 2012 to sixth place in global payments in 2017, according to SWIFT (see Figures 1 & 2 below).1 This will only increase with a renewed commitment to the “Belt & Road Initiative” (BRI) fuelling the long-term growth of the RMB, with over forty countries now involved in China’s major trade and investment program.2

At the same time, Asia-based banks and businesses are developing “local-to-local” networks between country, regional and global markets that support the growing role of the RMB through global hubs like Singapore, a financial centre that will be at the forefront of facilitating RMB and BRI investments across Asia, and in particular ASEAN, going forward.

FIGURE 2

Currency’s share as an international payments currency

Customer initiated and institutional payments. Messages exchanged on SWIFT. Based on value. September 2017.

Source: SWIFT Watch

CHINA’S CURRENCY ENGINEERS

The People’s Bank of China (PBOC) and the Chinese central government in Beijing have been in pursuit of RMB internationalization for over 10 years, and despite some minor course changes, important milestones continue to be achieved.

In the past year, we have seen the induction of China’s equity markets into the MSCI Emerging Markets Index, new settlement systems for the RMB, and an increased focus from Beijing on utilizing the country’s own currency to support over half a trillion RMB of future loans for BRI. Importantly, as of June 2017 China expanded its bilateral currency swap agreements to 36 countries, of which 24 are countries within the BRI, according to Moody’s.3

WHAT’S IN STORE FOR 2018?

For 2018, the engineers of global RMB growth in Beijing have signalled that the next series of major investment and trade channels will soon be established. While the details are still being determined, Bond-Connect will for the first time lead China’s massive USD 9.4 trillion debt market to be fully opened to international investors. With only 2% of Chinese debt currently being held by overseas buyers, Bond Connect will establish critical new global linkages for the RMB to be used by international investors.4 In turn, global asset allocations for the China market will steadily increase, and create signifcant debt opportunities for Chinese corporates and investors alike.

Another major initiative that, if successful, would further reinforce global RMB flows is Beijing’s support to create new oil benchmarks for the “petroyuan”, which could eventually allow the world’s largest energy consumer to use its own currency when securing long-term supply contracts. China’s state banks will likely be the initial leaders behind the petroyuan in order to ensure sufficient liquidity exists in the underlying market. That said, China has already opened more than 6,000 trading accounts this year for long-awaited crude futures contracts – with three-quarters coming from individual traders, demonstrating the domestic retail interest alone in this new market.5 Over time, we could expect to see RMB ows begin to proliferate from oil-producing regions into other new markets, as well as additional commodities transacting in China’s currency.

THE SINGAPORE CONNECTION

While no single development will likely mark the moment when the RMB has become fully internationalized, an inflection point has arguably already been crossed for the currency throughout Asia. In the right setting, banks and businesses outside China are now able to work on a daily basis with their Chinese commercial partners to build “local-to-local” networks that allow the RMB to be utilized across country, regional and global markets.

Singapore has long remained the financial core of South East Asia (ASEAN), and since the era of globalization began, the city has renewed its role as the cultural, transportation and economic gateway into the region. In 2015, investments from Singapore into Malaysia and Indonesia alone were over USD 60 billion.6 In the process, Singapore and the financial institutions based there have developed deep connections with neighboring economies that allow for the growth of commodity trade and investment flows to proceed smoothly.

_________________________________________________________________________________________

CHINESE FINANCIAL INSTITUTIONS AND CORPORATES INCREASINGLY PREFER SINGAPORE AS THE HUB OF CHOICE FOR FACILITATING INVESTMENTS INTO ASEAN

_________________________________________________________________________________________

These strengths are now evolving to establish the foreign exchange, currency settlement, capital raising, and regulatory linkages outside of China for the RMB. Yuan-clearing volumes by the Industrial and Commercial Bank of China Singapore reached a total of RMB 170 trillion Yuan at the end of July 2017 – a signifcant figure.7 Far from being led by the well-planned calculations of the engineers behind RMB internationalization in Beijing, however, it is the off shore banks and businesses that understand the true commercial reality of China’s currency that are developing “local-to-local” networks through hubs like Singapore.

With Chinese investors and companies now increasingly approaching financial advisors on how to transact in South East Asia using the RMB, Singapore’s position in the region has allowed multi-national banks based in the city as well as local markets

to customize new currency systems to each individual country’s regulatory requirements.

As a result, Chinese financial institutions and corporates increasingly prefer Singapore as the hub of choice for facilitating investments into ASEAN, and in turn establish new currency channels with global markets that connect through the city. With over 6,500 Chinese companies currently located in the city, Singaporean banks are helping firms such as Baosteel, New Hope and Huaneng to invest in the region through their local subsidiaries.8 Major firms like Lenovo have also established regional finance and treasury centres to take advantage of Singapore’s banking and capital markets to finance their regional expansion.9

Over the medium-term, BRI will likely emerge as an important driver of RMB demand in Asia and ASEAN. After a period when major Chinese investments were being made in USD, President Xi Jinping this year has clearly indicated his preference for China to support large-scale infrastructure projects through RMB-denominated lending from now on. BRI Infrastructure investments will likely provide a major boost to trade ows as well, and ASEAN is already predicting that by 2020 the region is expected to reach USD 1 trillion in trade with China per year.10

INTRA-REGIONAL SOLUTIONS

However, for any financial architecture to be built correctly, deep knowledge on how to access local (Asian) markets and secure linkages between global financial hubs is required. Whilst the strategic direction of the RMB will continue to be set by the PBOC, and overall currency flows fluctuate, it is the banks that are creating solutions that will facilitate the long-term day-to-day usage of the RMB in international markets.

For Chinese businesses to establish multi-national operationsacross Asia, a financial partner with strong onshore and offshore capabilities is critical. Among the growing examples of solutions that banks have created, two can be highlighted that demonstrate how Intra-Regional networks have been built to facilitate RMB usage in new and important ways.

THE NEW RMB REALITY

While near-term outlook on RMB usage among global currencies may fluctuate, this picture is set to change as BRI takes shape. Estimated to reach over USD 1.3 trillion in total investments by the mid-2020s, the sheer size and ambition of BRI will need participation of solutions banks who will provide the structural, legal, and financing framework for it to be a success. Much of China’s investment in ASEAN will likely be project financing related, particularly oil exploration, pipelines and ports in support of long-term trade growth.

One can also anticipate that the Asian Infrastructure Investment Bank (AIIB), with China as the largest shareholder, will play a key part project financing – either as direct lender, or guarantor – and execution requires the expertise of strong institutional banks, which have the cross-product depth to structure loans, evaluate and distribute risks, and provide settlement services among others.

The framework brings Singapore front and centre within the regional banking system – where it is already the preferred booking point for offshore loans into ASEAN, and increasingly into mainland China. Singapore will remain the only regional financial centre where banks have the depth of capital and expertise within their local branches to take on the types and levels lending customers require in BRI projects.

Positive developments have been created by global financial institutions that have the ability to secure stronger RMB linkages throughout ASEAN. As a strong regional player, ANZ has the capability, regulatory knowledge and long-term commercial experience to secure new RMB relationships with Chinese and local clients in the region, as well as China’s onshore markets. As business ties between China and Singapore continue to expand, these important intra-country linkages will make the RMB an essential currency for supporting regional growth.

1 SWIFT – RMB Tracker October 2017, Euromoney – RMB payments in decline, but outlook positive says SWIFT & World Bank – Global Trade (% of GDP)

2 HKTDC – The Belt and Road Initiative: Country Profiles

3 Caixin – ‘Belt and Road’ Helps China Offload Overcapacity

4 Bloomberg – China Set to Expand Opening to $9 Trillion Bond Market

5 Reuters – China sets sights on oil benchmark after years of delays

6 Government of Singapore – Direct Investment Abroad

7 Straits Times – Pricing oil in yuan may be next move in China’s currency ambitions

8 MAS – China-Singapore Financial Connectivity

9 MAS – China-Singapore Financial Connectivity

10 China Daily – China-ASEAN trade to hit $1t by 2020

RELATED INSIGHTS AND RESEARCH

insight

Why Reg-S Bonds Are Booming Down Under

There’s never been a better time for Australian borrowers to raise funds in Asia’s US dollar RegS bond market. The RegS issuance data in Asia speaks for itself - deal volumes have broken records in 2017, up 67% year-on year to US$257bn by mid-November, and this trend was reinforced by the speakers at our recent ANZ Aussie Day conference in Hong Kong.

insight

Why It's High Time to Dip into Asia's RegS Liquidity Pool

Rising middle class wealth in Asia has triggered a revaluation of global credit among Asian investors, especially the offshore US dollar bond market. This revaluation has created a deep pool of liquidity across the world's most dynamic region for both issuers and investors.

research

Australia Property - Bubble or Squeak?

ANZ's senior economist, Daniel Gradwell, speaks with David Kobritz, Managing Director of Deal Corp in our latest podcast.