INSIGHT

Seeking Alpha In A Stable Market: Why Reg-S Bonds Are Booming Down Under

Download the PDF

Paul White & Jimmy Choi, Co-Heads of Capital Markets, ANZ | December, 2017

________

There’s never been a better time for Australian borrowers to raise funds in Asia’s US dollar Reg-S bond market. The RegS issuance data in Asia speaks for itself - deal volumes have broken records in 2017, up 67% year-on year to US$257bn by mid-November, and this trend was reinforced by the speakers at our recent ANZ Aussie Day conference in Hong Kong.

This year was notable for the number of Australian borrowers raising funds in Asia’s Reg-S market. Year to mid-November, 11 Australian corporate issuers had sold bonds in excess of US$10b combined. The issues span a range of industries across investment grade, high yield and unrated names, and have access to tenors of 5-, 10-, 20-years and even perpetual bonds.

Why is Australia such a compelling part of this story? And why now? The reasons are simple: Australian issuers are seeking to tap into new pools of liquidity, while at the same time many Asian investors are seeking stability, diversity – and the potential for alpha in the world’s fastest growing region.

The wave hasn’t crested

Here’s the good news: Asia’s Reg-S record breaking trend looks set to continue, given the sustained expansion of the region’s bond markets: ANZ is predicting the Asia ex-Pacific dollar bond universe will be worth US$1trn by 2020.

“This year the demand for increased duration, diversification and the rise of liquidity has been the biggest driving force in Asia’s bond market and as we head into the end of the year we are confident these trends will continue in 2018,” said Farhan Faruqui, Group Executive, International at ANZ.

“We’ve also seen an increase in the number of Australian issuers as they diversify their funding sources into Asia and there is increased demand for Australian credits which offer diversification, relative value and tenor,” said Mr Faruqui, who was speaking at the Hong Kong leg of the ANZ Aussie Day roadshow, which hosted 170 investors and facilitated over 150 one-on-one meetings with Australian issuers in three locations (Tokyo, Hong Kong and Singapore) over three days.

________

"This year the demand for increased duration, diversification and the rise of liquidity

has been the biggest driving force in Asia's bond market"

Farhan Faruqui, Group Executive, International at ANZ

________

Asian RegS comes of age

Asia’s Reg-S market has not always been so robust. In the past, if Australian corporates wanted US dollar funding, the first and only real choice was to sell through the 144A market, which is for US-based investors. While that market still accounts for the majority of Australian US dollar bonds, there has been a shift towards Asia — which both issuers and analysts predict will only accelerate in coming years.

“Eight years ago we needed to raise US$800m of 10 year money and as a freshly-rated triple-B credit we didn’t have confidence in the Reg-S market so we had no choice but to go to the 144A market,” said Geoff McMurray, General Manager Capital Management and Chief Risk Officer at Incitec Pivot.

“But when we last issued in July, it made more sense to go the Asian Reg-S market. It was more mature, could price our credit accurately and there was tenor and size available.”

ANZ was joint global coordinator and joint lead manager for Incitec Pivot’s US$400m 3.95% 10-year bond that priced at a spread of 1.675% over US Treasuries.

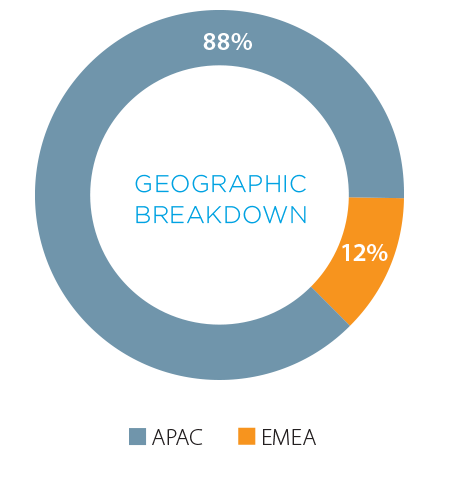

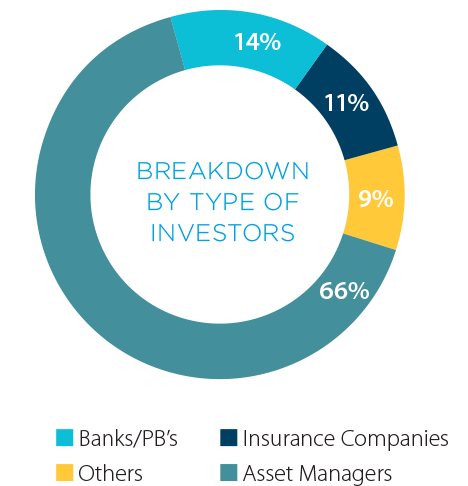

FIGURE 1

Investor demand breakdown for Incitec Pivot’s US$400m 3.95% August 2027 bond

The ability to secure size and tenor was one of the factors that all the treasury officials attending ANZ Aussie Day said was an attractive feature of the Asian US dollar bond market. Asia’s Reg-S bond investors have also shown an appetite for non-rated Australian credit, which was an important factor when looking where to fund, according to Edward Collis, Group Treasurer at recruitment website Seek.

“We recently set up a Reg-S only EMTN programme and as we don’t have a rating, we are pleased to see there is significant appetite for unrated Australian names,” said Collis.

A seemingly insatiable appetite

The benefits of diversification and the range of tenors on offer are clearly two of the main reasons Asian investors are piling into the Australian credit markets. The maturity sweet spot for Asian borrowers tends to be in the three-to-five year range. Yet, Asia’s growing pension and insurance liabilities means there is increasing demand for longer-dated notes.

“Australian credit belongs to one of our favoured asset classes of the last few years,” said Ben Yuen, Chief Investment Officer, Fixed Income at BOC HK Asset Management. “It offers a very important source of diversification for our portfolios.”

The relative value Australian credits offer compared to issues in other major Asian markets is also a draw for the region’s investors. Investors view Australian issuers as offering both the lower risks associated with a developed market and a strong regulatory regime, as well as the potential to deliver alpha as issuers seize the growth opportunities Asia offers. All but one of the US dollar bonds from Australian issuers have traded up this year, with many of the high yield names recording double-digit spread tightening, according to ANZ data.

The only real complaint Asian investors have about the Australian credit market is that there are not enough issuers to meet the demand. Increasing the number of issuers will have benefits for market development and investors, said Arthur Lau, Co-Head of Emerging Markets Fixed Income and Head of Asian ex-Japan Fixed Income at PineBridge Investments.

“We need more names, not just in high yield but also in investment grade. If the Australian universe can expand, it will improve the understanding of the asset class and be positive for Asian investors.”

FEATURED ARTICLES

research

2018 Outlook

ANZ Research looks ahead to 2018 with the expectation that the recent global lift in growth will be tested.

insight

Why It's High Time to Dip into Asia's RegS Liquidity Pool

Rising middle class wealth in Asia has triggered a revaluation of global credit among Asian investors, especially the offshore US dollar bond market. This revaluation has created a deep pool of liquidity across the world's most dynamic region for both issuers and investors.

insight

India Rises On Its Own Terms

India is leveraging demographics and policy to grow in a world very different from when China began to rise: the eve of the Fourth Industrial Revolution.