RESEARCH

ALONG THE MEKONG: A NEW REGIONAL NETWORK TAKES SHAPE

Download PDF

By Eugenia Victorino, Economist, ANZ | October, 2016

________

TRANSPORT CORRIDORS SET TO ENHANCE CONNECTIVITY AND ACCELERATE COMMERCE

We are on the cusp of a better-connected Greater Mekong Region (GMR) that will play a much more prominent role in regional business and logistics. The GMR – which spans Southwest China, Cambodia, Laos, Myanmar, Thailand and Vietnam – has of course always been strategically significant, at the crossroads of economic powerhouses China and India and acting as a conduit for commerce between South China and Southeast Asia. But limited development and infrastructure have kept the GMR from fulfilling its potential as a focal point of Asian trade.

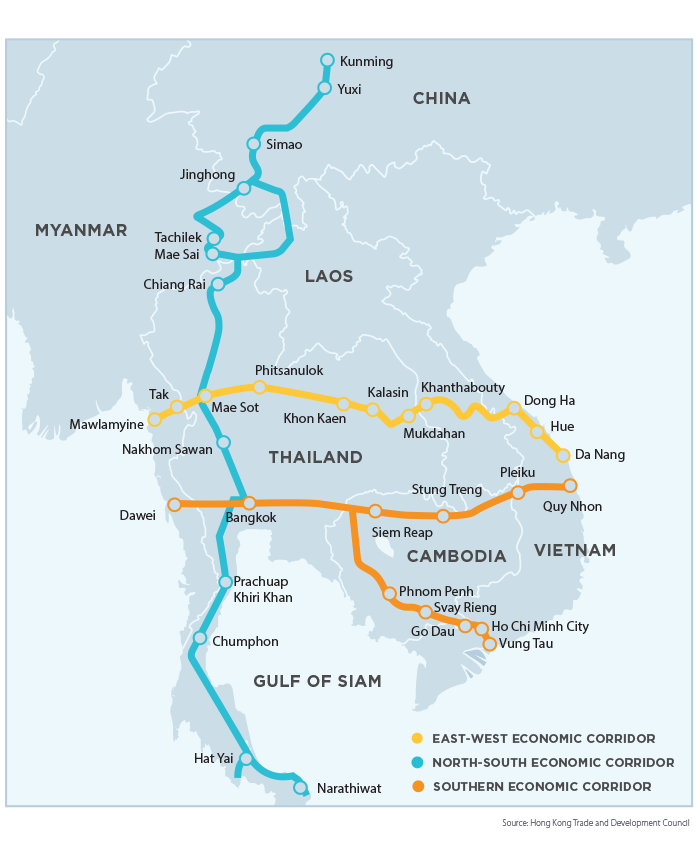

Better cooperation and a surge in infrastructure investment – much of it concentrated around the special economic zones (SEZs) that have mushroomed in the GMR’s frontier economies – are creating new transport corridors that will speed flows of goods and services and add to the GMR’s allure as a manufacturing destination. These corridors include:

North-South Economic Corridor:

Arguably the most significant emerging trade route, this is a road and rail network that will eventually link Thailand’s capital, Bangkok, with the southern Chinese provinces of Yunnan and Guangxi, passing through eastern Myanmar, northern Laos and northern Vietnam. A major bottleneck to the development of this corridor was eliminated in 2013 with the opening of a bridge over the Mekong River between Chiang Kong, Thailand and Houayxay, Laos, and further upgrades are planned to road and rail connections that are still patchy in the corridor’s northern reaches.

East-West Economic Corridor:

This corridor involves the improvement of roads connecting Mawlamyine, a city on Myanmar’s east coast,

to the Vietnamese port of Da Nang, through central Thailand and Laos, potentially linking the Indian Ocean and the South China Sea. The logistics potential presented by this corridor is a significant attraction for investors in the Savan-Seno SEZ in Laos’s Savannakhet province, at the corridor’s heart. Savannakhet’s border crossing with Thailand has seen rising bilateral trade and is also likely to encourage more firms to explore a ‘Thailand-Plus-One’ model in which Thailand remains the main manufacturing base but some capital-intensive processes are shifted to Laos, where electricity rates and wages are lower.

Southern Economic Corridor:

This runs from Myanmar’s Dawei port through central Thailand and Cambodia to the Vietnamese ports of Quy Nhon and Vung Tau, along Cambodia’s national highway 1. The Cambodian SEZs located on these routes will enjoy a prime position in this wider network. Our study showed that the Dragon King SEZ, on highway 1 near the Bavet checkpoint on the border with Vietnam, is already emerging as a hub in a ‘Vietnam-Plus-One’ model, in which raw materials and processing in Cambodia feed into Vietnam’s generally more comprehensive production facilities, while skills and training are transferred in the other direction. In Myanmar, this corridor could ensure Dawei is not eclipsed entirely by the recently-launched, Japanese-managed Thilawa port and SEZ to the south, which was rated highly by investors in ANZ’s study for its solid infrastructure and lack of red tape.

GMR governments and multilateral aid agencies have made cultivating these corridors a clear priority. The routes have exciting implications for regional production strategies, particularly when seen as part of a wider push for connectivity in Asia, evident in initiatives such as the South Asia Subregional Economic Cooperation’s effort to develop its own transport corridors and China’s One Belt, One Road program.

However, the development of these routes also has to be put in perspective. Physical barriers such as rivers or unpaved roads remain an issue, and even addressing these is only half the battle. The companies surveyed in the ANZ study unanimously identified the high cost of logistics in the GMS as a challenge, and varying customs procedures and standards continue to challenge the smooth transfer of goods over GMS borders. Only as these are addressed will the region’s corridors become true trade accelerators.

RELATED INSIGHTS AND RESEARCH

For a full set of relevant disclosures, please visit the link below.

These publications are published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia on its Institutional website.

If you choose to access these materials, you agree that the Website Terms of Use apply. These publications are intended as thought-leadership material. They are not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in these publications is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in these publications constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in these publications is based on information available at the time of publication. While the publications have been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of these publications or the use of information contained in these publications. ANZ does not provide any financial, investment, legal or taxation advice in connection with these publications.

If you are resident or located in the United States of America, you agree that you are not acting on behalf of a natural or individual (including yourself) “U.S. person” (as defined in Regulation S of the U.S. Securities Act of 1933, as amended) and you agree not to transmit or otherwise send any information on this website to any natural or individual person in the USA or to publications with a general circulation in the USA.

If you are resident or located in New Zealand, you are a “wholesale client” under the Financial Advisers Act 2008 (NZ), as amended.

Please confirm that the above statements are correct.