CASE STUDY: Financing Business Interests

Investing in Tertiary Education

“Despite recent volatility in global markets, ANZ ensured we received exceptional investor support for our offering.”

finance business interests

We have a range of solutions to suit your needs.

Find out more about financing your business interests with ANZ.

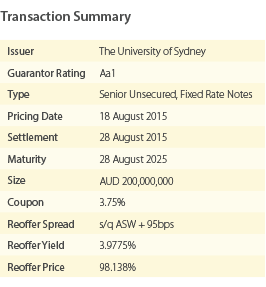

In August 2015 we made a return to our local market, issuing AUD200m of senior unsecured, fixed rate notes that would take the university’s total outstanding domestic volume to AUD400m.

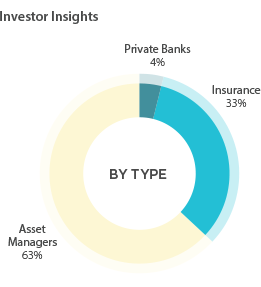

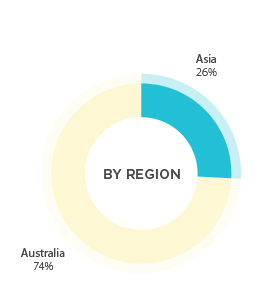

ANZ secured such exceptional investor support for the transaction that not only was our order book comprised of high calibre international and local investors, it was oversubscribed. Our initial offering was upsized from AUD100m to AUD200m, despite recent volatility seen across global markets.

How? The bank worked with us on a series of calls to key Asian accounts and ran successful roadshows for us in Sydney and Melbourne. In the end 50% of the orders we received came from investors spoken to during this time, with over 25% of the final deal taken up by Asian accounts.

The University of Sydney

Ranked in the top 0.3% of universities worldwide, The University of Sydney’s strategy is simple: create a place where the best researchers and most promising students can achieve their full potential. They continue to invest in outstanding research, ensuring the best of their work nationally, regionally and internationally is well supported with the right people, equipment, and physical infrastructure.

RELATED CASE STUDIES

case study

Financing Business Interests: Navigating Global Capital Markets

Exceeding expectations is about sound advice and good investor relations.

case study

Financing Business Interests: Making a Capital Market Debut

Engaging investors is the key to a successful issuance.

case study

Financing Business Interests: Investing in Telecommunications

Securing strong investor demand is down to reputation as well as a good offering.