CASE STUDY: Financing Business Interests

Navigating Global Capital Markets

“ANZ’s sound advice and direction meant we were able to successfully navigate the global capital markets’ recent volatility and achieve an outcome that exceeded our expectations.”

finance business interests

We have a range of solutions to suit your needs.

Find out more about financing your business interests with ANZ.

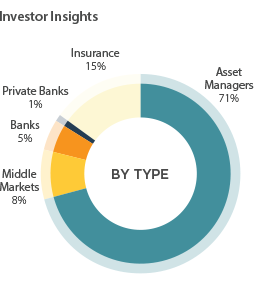

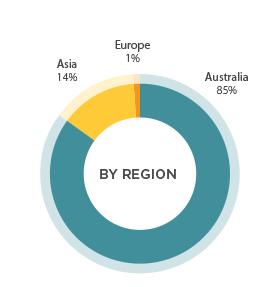

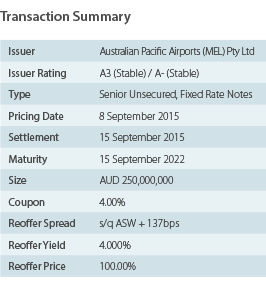

Our return to the Australian domestic market in September 2015 was so successful that we capped our issue at AUD250m despite the order book growing to AUD450m. The transaction exceeded our expectations but we had achieved our objectives.

Primary success factors included:

- ANZ’s good pipeline visibility.

- Sound advice in a challenging market.

- Strong investor engagement prior to launch.

It must be acknowledged that the Asia/domestic investor roadshows in Hong Kong, Singapore, Tokyo, Sydney and Melbourne were a great marketing tool. The majority of the total orders came from buy and hold investors who participated in the roadshow.

About Melair

Melbourne Airport is owned and operated by Australia Pacific Airports (Melbourne) Pty Ltd, MELAIR. The airport operates under a 50-year long-term lease from the Federal Government, with an option for a further 49 years. MELAIR’s parent company, Australia Pacific Airports Corporation, is a privately held corporation owned by institutional investors, predominantly superannuation/pension funds.

RELATED CASE STUDIES

case study

Financing Business Interests: Making a Capital Market Debut

Engaging investors is the key to a successful issuance.

case study

Financing Business Interests: Investing in Telecommunications

Securing strong investor demand is down to reputation as well as a good offering.

case study

Financing Business Interests: Investing in Tertiary Education

Obtaining exceptional investor support despite market volatility.