RESEARCH

Wages — And Ambitions — Rise As Mekong Workforce Enters A New Era

Download PDF

By Eugenia Victorino, Economist, ANZ | November, 2016

________

Can mekong countries foster skilled labor while retaining competitiveness?

The nature of labour in the Greater Mekong Region (GMR) is changing, as the special economic zones (SEZs) that have emerged throughout the frontier GMR economies – Cambodia, Laos, Myanmar and Vietnam – equip workers with new skills and also new expectations. Managing this transformation of the workforce is one of the key challenges these markets will face in the years ahead.

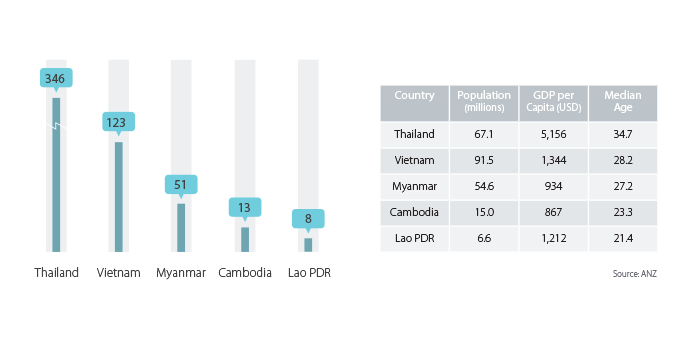

Investors are drawn to GMR SEZs for many reasons, such as tax incentives, logistics advantages and stable infrastructure. But access to relatively young,low-cost workers is key to their appeal compared to other manufacturing destinations. The median age in Laos for example, is 21.4, versus 34.7 in Thailand; International Labour Organisation (ILO) data shows the average monthly wage in Cambodia in 2013 was USD121, compared to USD613 in China.

FIGURE 1:

Surveying A Disparate Region

2011 GDP (USDbn)

This has encouraged some investors to shift low value-added production to Laos, Cambodia and Myanmar to support existing manufacturing operations in nearby Thailand or Vietnam, in what’s called a ‘plus 1’ strategy.

As regional infrastructure and transport connections improve, this strategy becomes easier to adopt. But for how long? ANZ research based on extensive surveys of SEZ-resident companies indicates the GMR may already be approaching a labour turning point.

There is no doubt that by exposing workers to modern production lines and — as they are typically foreign-owned and managed — English and other languages, SEZ companies are helping build the skills of the GMR workforce. However, with the development of skills, wage inflation has rapidly emerged as an issue, particularly for firms operating at the higher end of the value chain.

This ‘tipping point’ is especially evident in Cambodia, where companies are already citing both labour costs and turnover as problems, suggesting more are offering higher wages in an attempt to retain staff. Labour costs in Laos remain competitive, but the emergence of skilled labour there will inevitably lead to wage hikes that will make the country less cost-competitive unless they are accompanied by productivity gains.

Unfortunately, wages and productivity do not necessarily rise in tandem. In Vietnam, the most established FDI destination among the GMR frontier economies, high turnover and low skills were cited as the biggest labour issues among the firms ANZ surveyed.

Some companies are attempting to address these gaps by investing heavily in training. In Myanmar’s Thilawa SEZ, for example, one firm surveyed by ANZ habitually sends local workers to Vietnam for month-long periods to study things like welding, customs procedures and human resources. One potential issue with such an approach is that the investment becomes a sunk cost should newly skilled workers leave to pursue other opportunities.

The GMR markets thus face a conundrum: rising investment and the journey up the manufacturing value chain will require more skilled labour, but developing this labour will erode these markets’ cost advantages, and may exacerbate rather than resolve the issue of high employee turnover.

In ANZ’s view the SEZs could play a role in helping the GMR reach a state where the supply and demand of skilled labour is more evenly balanced. First, more SEZ resident companies could forge links with universities or vocational institutions to offer students workplace experience and embed skills at a younger age. Less than half the companies surveyed in Vietnam reported these kinds of links.

We also see significant potential in ‘train the trainer’ initiatives that are already emerging in places like Myanmar and Cambodia, where local SEZ workers are increasingly learning from their Vietnamese counterparts. The transfer of skills from Vietnam to other Mekong economies is a clear regional dynamic and points to the region addressing its own capacity issues. At the workplace level, these programs can also act as incentives for talented workers and contribute to employee retention.

RELATED INSIGHTS AND RESEARCH

For a full set of relevant disclosures, please visit the link below.

These publications are published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia on its Institutional website.

If you choose to access these materials, you agree that the Website Terms of Use apply. These publications are intended as thought-leadership material. They are not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in these publications is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in these publications constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in these publications is based on information available at the time of publication. While the publications have been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of these publications or the use of information contained in these publications. ANZ does not provide any financial, investment, legal or taxation advice in connection with these publications.

If you are resident or located in the United States of America, you agree that you are not acting on behalf of a natural or individual (including yourself) “U.S. person” (as defined in Regulation S of the U.S. Securities Act of 1933, as amended) and you agree not to transmit or otherwise send any information on this website to any natural or individual person in the USA or to publications with a general circulation in the USA.

If you are resident or located in New Zealand, you are a “wholesale client” under the Financial Advisers Act 2008 (NZ), as amended.

Please confirm that the above statements are correct.