INSIGHT

ASX-LISTED INVESTMENT VEHICLES ARE CHANGING FAST – WHAT DOES IT MEAN FOR FUND MANAGERS?

Download the PDF

Sponsors

Andrew Palmer, Head of Financial Institutions Group, Australia

Phil Carmont, Head of Funds, FIG Australia

Authors

David Rosenthal, Director – Funds, FIG Australia

Kevin Wong, Director – Client Insights and Solutions

(With contribution by Vaibhav Garg, Analyst – Client Insights and Solutions)

April, 2018

________

WHILE LISTED INVESTMENT VEHICLES (LIVS) HAVE BEEN AROUND FOR A LONG TIME, 2017 WAS A WATERSHED YEAR IN IPOS... THE SIZE OF THESE LIV RAISINGS HAVE LED TO ELEVATED INTEREST IN THE SECTOR BY A RANGE OF LOCAL, REGIONAL AND GLOBAL PLAYERS.

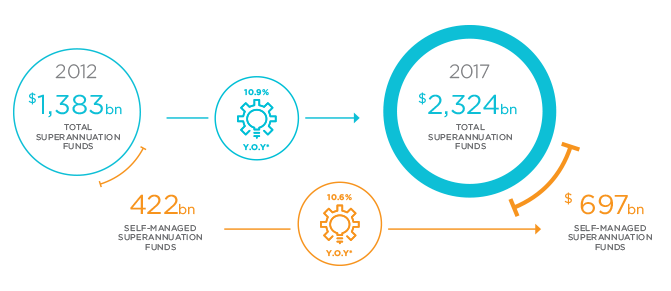

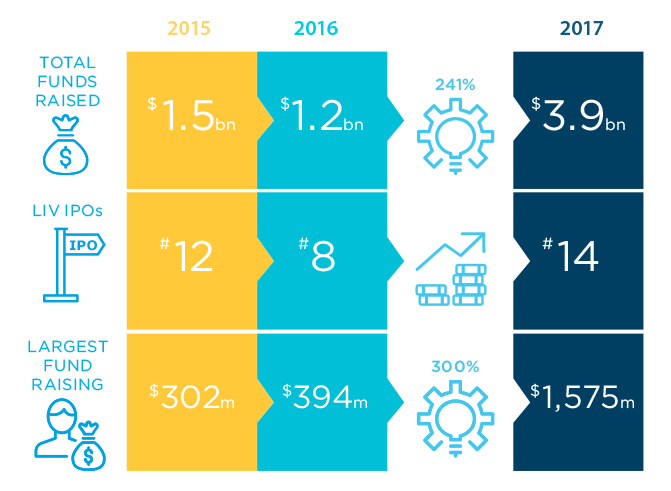

In 2017, Listed Investment Vehicles (LIVs) on the Australian Stock Exchange (ASX) experienced a massive surge in public raisings, with almost A$4 billion raised via Initial Public Offerings (IPOs) during the year. This was over double the A$1.2 billion raised in 2016!

The three largest new LIVs in 2017 – namely VGI Partners Global Investments Ltd (VG1), MCP Master Income Trust (MXT) and Magellan Global Trust (MGG) – introduced several key structural innovations to the market. In this article, we discuss these innovations, how they benefit investors and what they could mean for fund managers’ own capital and risk management needs.

2017 WAS A WATERSHED YEAR FOR LISTED INVESTMENT VEHICLES

While LIVs have been around for a long time, 2017 was a watershed year in IPOs. VG1, MXT and MGG, as the three largest transactions, each raised over A$500m in investor monies. From our discussions with fund management industry participants, the size of these LIV raisings have led to elevated interest in the sector by a range of local, regional and global players.

If new LIVs can generate such demand on a consistent basis from a predominantly retail investor base, then the sector presents a more compelling source of scale for new assets under management. From what we know, the pipeline of new LIVs appears to be very strong.

FIGURE 1:

ASX Listed Investment Vehicles – spectacular growth in 2017

Source: ASX filings, entity reports, ANZ estimates

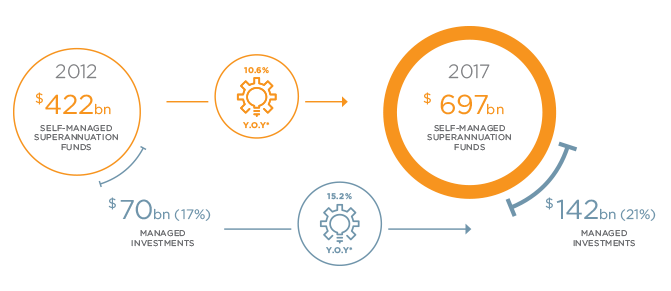

We believe that the intersection of several investor themes has led to renewed focus on the LIV structure among many fund managers: growth in self-directed investment flows, especially Self-Managed Superannuation Funds (SMSFs); demand for easy access to diverse investment strategies; historical challenges associated with LIVs’ investor friendliness; and structural changes to distribution channels.

In the SMSF segment, allocation to managed investments in various forms (e.g. listed and unlisted trusts) has risen from around 17% to 21% over the five year period to June 2017. This is in the context of average annual growth in total SMSF assets of over 10% in the same time frame! We see this as an obvious signal that managed investments products have benefited from compulsory superannuation growth in the self-directed space.

FIGURE 3:

SMSF asset allocation to listed trusts, unlisted trusts and other managed investments

*Y.O.Y refers to year on year growth

Source: Australian Prudential Regulation Authority Statistics – Quarterly Superannuation Performance (June 2017), Australian Taxation Office – Self-managed super fund statistical report (June 2017), ANZ estimates

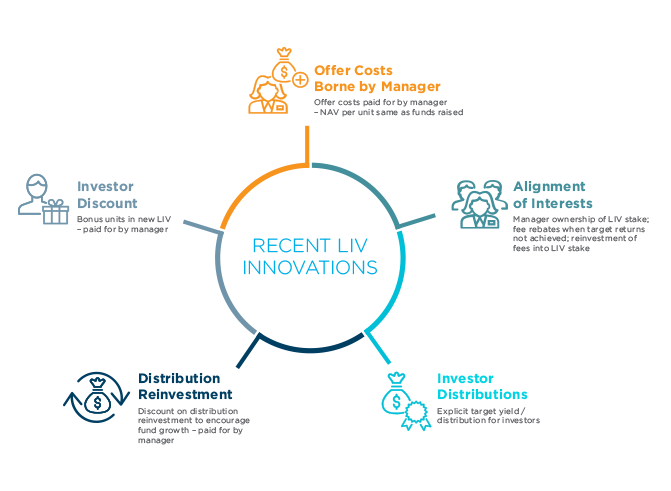

WHERE IS THE INNOVATION TAKING PLACE?

Recent LIV IPOs saw fund managers absorb the offer costs instead of investors, marking a clear break from past practice. Offer costs are material, taking as much as three percent of total funds raised. If the manager absorbs the offer costs, the opening net asset value per share or unit will be equal to the application price – in earlier IPOs, the investors had to deal with an immediate value hit on the first day of trading.

New mechanisms used to promote fund growth include: allocation of bonus subscription units to eligible investors to drive initial demand; a distribution reinvestment plan discount to encourage ongoing reinvestment and therefore organic fund growth; and mandatory reinvestment of the surplus return above a target distribution rate.

Alignment of the interests of fund managers and investors has been improved through a variety of arrangements, including: rebate of manager performance fees should target returns not be achieved; reinvestment of performance fees into LIV shares; and long-term escrow agreements.

Finally, a clear distribution target was set by certain LIVs to cater to those investors seeking an income stream as part of their financial planning.

We consider that these recent structural innovations all serve to make LIVs more investor friendly, especially when combined with ASX-listed liquidity and a growing range of investment strategies on offer. Arguably, the fact that MGG, MXT and VG1 collectively raised over A$2.6 billion reflects the success of the investment case they made to investors, including the various innovations described above.

We strongly believe that given the attractiveness of the LIV sector to fund managers, further innovation can be expected as new listings come to market.

_________________________________________________________________________________________________________

FUND MANAGERS IN TURN WILL NEED TO CONSIDER THEIR CAPITAL PLANNING TO PAY FOR THESE LIV-RELATED COSTS... DEPENDING ON INVESTMENT STRATEGIES, MANAGERS WILL ALSO HAVE TO CONSIDER A RANGE OF RISK MANAGEMENT ISSUES.

_________________________________________________________________________________________________________

IMPACT ON THE LIV FUND MANAGER’S CAPITAL AND RISK MANAGEMENT NEEDS

From an investor perspective, having the fund manager pay for offer costs, subscription discounts and/or distribution reinvestment plan discounts, provides tangible financial benefits from day one. Fund managers in turn will need to consider their capital planning to pay for these LIV-related costs. To the extent that the manager has excess cash on hand, they can utilise internal resources – alternatively a bank facility could make financial sense in optimising the cost of capital. Fund managers can then deploy their existing cash elsewhere to generate better returns than the borrowing costs.

In addition, fund managers may wish to launch a series of LIVs over time. As such, these fund managers should contemplate their longer term funding plan to address LIV-related costs.

Depending on investment strategies, managers will also have to consider a range of risk management issues, such as liquidity and cash management in the portfolio (e.g. for asset rebalancing and target cash distributions), and FX spot and hedging for foreign currency exposures. The capacity to use leverage in the investment portfolio could also enable fund managers to improve investment returns and distribution yields.

KEEP A CLOSE EYE ON LIVS

We think the ASX-listed LIV space will continue to develop at a rapid pace, as the opportunity it represents to fund managers has been highlighted through the funds under management attracted in 2017.

Industry participants who have an interest will have to keep a close eye on a range of topics, including investor-friendly innovations, capital planning and risk management.

RELATED INSIGHTS AND RESEARCH

insight

The Evolution of FX Risk Management Funds

History shows ignoring FX shifts can prove costly for fund managers – and in 2018 that remains truer than ever, especially for sector-specific specialty funds and long-dated funds that traditionally rely on forwards to manage FX risk.

insight

Why It's High Time to Dip into Asia's RegS Liquidity Pool

Rising middle class wealth in Asia has triggered a revaluation of global credit among Asian investors, especially the offshore US dollar bond market. This revaluation has created a deep pool of liquidity across the world's most dynamic region for both issuers and investors.

insight

Are Pan-Asian Corporates Missing the Formosa Opportunity?

In recent years, Taiwan’s ‘Formosa’ bond market – which refers to bonds issued in Taiwan but denominated in currencies other than the New Taiwan dollar – has emerged as a leading offshore fundraising destination. But are pan-Asian corporates taking advantage of the opportunity it presents?