INSIGHT

Asian Asset Management: Strategies For Regional Success

Download the PDF

By Dominique Blanchard, Head of Markets Sales, ANZ | May, 2017

The fourth article of the ‘Signals from the Noise: Distinguishing Hype from Opportunity in Asian Asset Management’ series, produced in collaboration with FT Confidential Research.

________

AS ASSET MANAGERS DEEPEN THEIR ASIA-RELATED OFFERINGS TO SEIZE THE OPPORTUNITIES EMERGING IN THE REGION, THEY WILL NEED TO DEVELOP STRATEGIES THAT TAKE INTO ACCOUNT SHIFTING DEMAND PATTERNS — WHICH IN MANY CASES WILL NOT BE CONSISTENT ACROSS MARKETS — AND CLEARLY DEMONSTRATE THEIR VALUE TO THE REGIONAL INVESTOR BASE.

DIVERSIFIED PRODUCTS

With regard to Asia-focused products, market participants say, demand for country-specific, index-benchmarked funds is giving way to multi-country portfolios, as well as multi-asset and alternative products. Investors are looking further for yield, towards less liquid assets such as real estate and infrastructure. This is matched, from the perspective of the users of capital, by a secular reduction in bank financing for longer-dated and more risky investments, owing to increasingly costly capital requirements and prudential regulation.

The result, in Asia as in the rest of the world, is that the provision of access to alternative asset classes will be an increasingly important value proposition, as will the ability to provide multi-asset and factor-based funds. This implies a trend towards a convergence of traditional and alternative fund managers, and even asset managers and hedge funds.

By extension, global asset managers that rely on traditional, single-asset or benchmark-linked funds will find it increasingly difficult to compete with local or regional asset managers offering the same thing — only cheaper and with a greater on-the-ground presence.

A TAILORED APPROACH

As discussed earlier in this series, tapping Asia’s growing wealth as a source of new fund inflows is becoming as crucial as selling Asia-focused products to the rest of the world. But the vast diversity among Asian markets means asset managers’ approaches will only be as successful as their ability to win business from specific investor bases and distribute funds in individual jurisdictions.

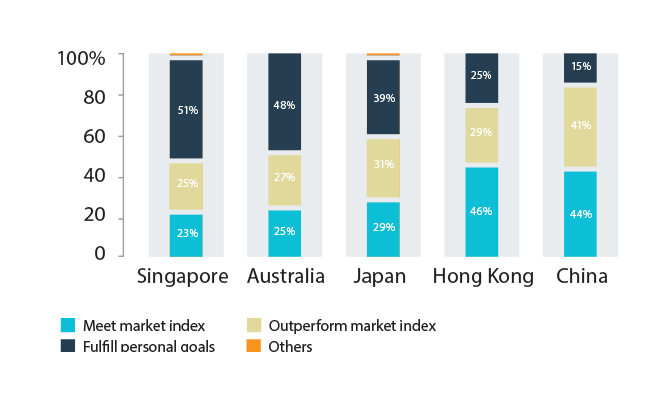

Here, local and regional players will inevitably tend to have an advantage, and pan-regional business approaches are unlikely to work. In a 2016 survey of wealth managers’ clients, for instance, consultancy EY found marked differences between markets, with those in Singapore and Australia more likely to take a goals-oriented approach, and those in Hong Kong and China more concerned about benchmarking against index performance.

Establishing, or bolstering, a local presence, is therefore increasingly vital for two reasons. First, it goes hand in hand with the drive for product diversification and specialisation, which will require more thorough on-the-ground research capabilities. And from a sales perspective, it will be necessary to build relationships among the region’s rising investor bases.

This speaks to the conundrum facing many global asset managers over the best means of accessing Asia’s varied markets. In the case of China, given the relatively slower expected pace of capital account liberalisation, and the fact that it remains a broadly domestic market, whether to go it alone or work with intermediaries remains a tough decision. Getting approval from the regulators to sell Hong Kongdomiciled funds in China through the MRF scheme is one thing; honing a successful distribution strategy is quite another.

FACTORING IN FINTECH

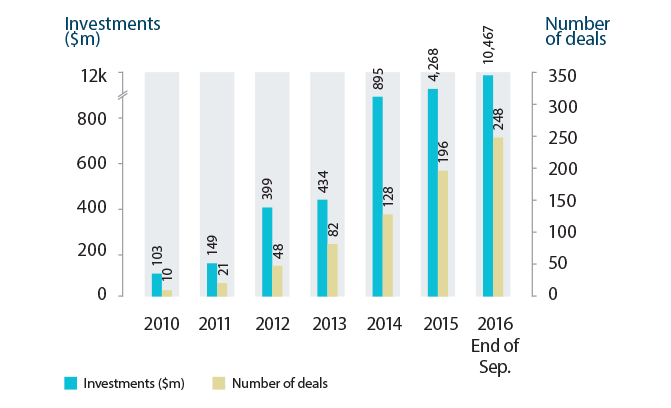

A further consideration is that the greater competition presented by fintech disruptors is no less acute in Asia than the rest of the world. Indeed, Asia is arguably now the world’s primary fintech battleground, with US$10.5bn invested in the sector in the first nine months of 2016 compared to US$6bn in the US — thanks in no small part to the colossal fundraising power of China’s internet finance giants, dominated by the Baidu-Alibaba-Tencent trio.

China is in many ways an anomaly, though, given the dominance of these players — in particular Alibaba, which more or less forced the evolution of Internet finance regulation through the phenomenal success of its Yu’e Bao money market fund, which reached 100m users within 20 months of its launch. Nowhere else in Asia is there a dominant fund supermarket or digital platform with similar scale, although there are many emergent platforms, as well as rising “robo-advisors”.

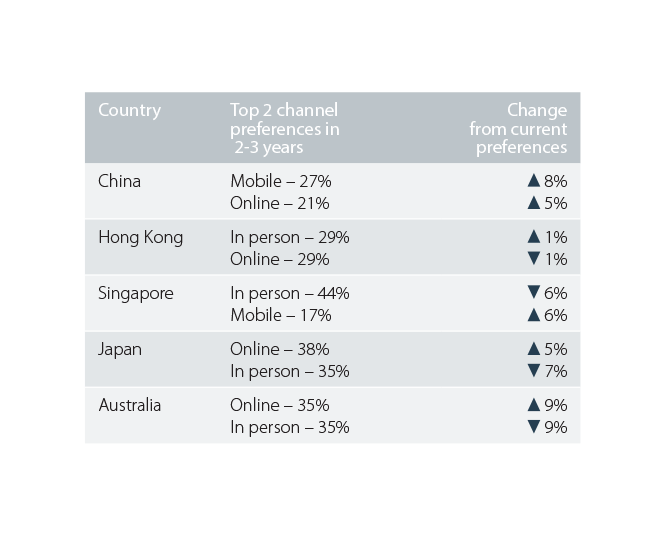

This underscores the sheer diversity of markets in Asia and the need for tailored approaches. The money flowing into fintech in China doesn’t change the fact that the average Asian investor prefers face-to-face interaction when receiving advice on how to invest his or her money.

This was picked as the most favoured channel of interaction by 39% of investors across five Asian markets in EY’s survey, followed by online (24%), phone (18%) and then mobile device (13%). Apart from in China, the shift in future years towards online and mobile channels in 2-3 years is likely to be modest.

In the longer term, this will make it vital to have a localised approach to reach Asia’s growing pool of savvy, technologically adept investors, probably through partnering with or co-opting dominant fintech standards as they arise.

This might ultimately obviate the need for a large physical sales and marketing presence. But in the short to medium term, asset managers will need to adopt a combination of digital and physical channels to investors, tailored to the buying behaviour of different segments.

To be sure, global managers still retain an edge in terms of their perceived expertise in global markets and in the soundness of their investment methodology. But they won’t retain this edge indefinitely. Asset managers polled by the FT and ANZ for this series emphasised the growing ambitions of Chinese domestic players and, in the longer term, the likelihood that they would rival and in some cases exceed offshore firms.

Elsewhere, with the possible exceptions of Japan and South Korea, competition from Asian asset managers with international ambitions is likely to be less acute. But the question remains in accessing these markets whether to partner with local distributors, such as banks or insurers, establish proprietary platforms or join forces with domestic players.

RELATED INSIGHTS AND RESEARCH

insight

Asian Asset Management: Currency Risk Management for Asia Funds

Managing currency risk will become an increasingly vital weapon in the global Asset Management manager’s arsenal.

insight

Asian Asset Management: China - Asia’s Future Asset Management Engine?

The opening of China’s capital markets is the biggest long-term driver of Asset Management activity in Asia.

insight

Asian Asset Management: A US$20trn Opportunity?

The Asia-Pacific Region will be crucial to the future of Asset Management, with AUM growing at nearly twice the global rate.