INSIGHT

Asian Asset Management: Fund Passporting — A Slow Burn

Download the PDF

By Dominique Blanchard, Head of Markets Sales, ANZ | May, 2017

The fifth article of the ‘Signals from the Noise: Distinguishing Hype from Opportunity in Asian Asset Management’ series, produced in collaboration with FT Confidential Research.

________

As the Asia-Pacific region comes into its own as an asset management market, one trend that will dominate in the years ahead is the rise of funds domiciled within the region. Locally developed funds that appeal to increasingly sophisticated regional investors will gradually take over from those designed primarily for investors (and regulations) elsewhere.

Regional fund passporting agreements, which allow funds approved for sale to investors in one market to also be distributed to investors in others, have the potential to help drive this trend. Such agreements include the 2014 ASEAN Collective Investment Scheme (CIS), grouping Singapore, Malaysia and Thailand; the 2016 Asia Region Funds Passport (ARFP), whose signatories so far include Australia, Japan, South Korea, New Zealand and Thailand (and whose last meeting was attended by Malaysia and Indonesia as observers); and the 2015 Mutual Recognition of Funds (MRF) scheme between Hong Kong and mainland China. At the end of 2016 Hong Kong also signed a Mutual Recognition memorandum of understanding with Switzerland.

FIGURE 1

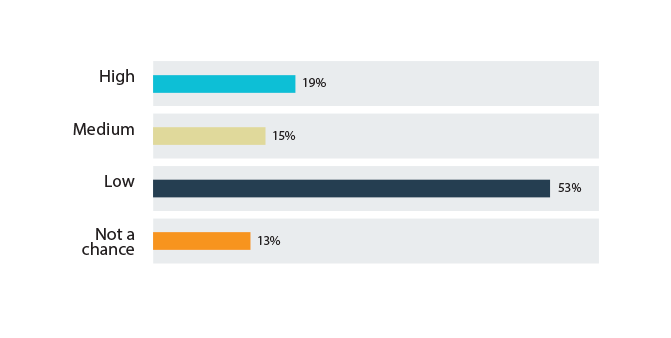

Will Asian passporting schemes replace UCITs?

Source: Brown Brothers Harriman survey

There is an expectation among some fund managers that these schemes may usurp the role played by UCITS, Europe-based crossborder funds that have proven popular with Asian investors due to their transparency and liquidity. In a 2015 poll of asset managers by Brown Brothers Harriman and Strategic Insight, over one-third (34%) saw a medium to high chance of an Asian fund passporting scheme replacing UCITS as the region’s dominant cross-border fund scheme by 2025.1

THE CHINA LURE

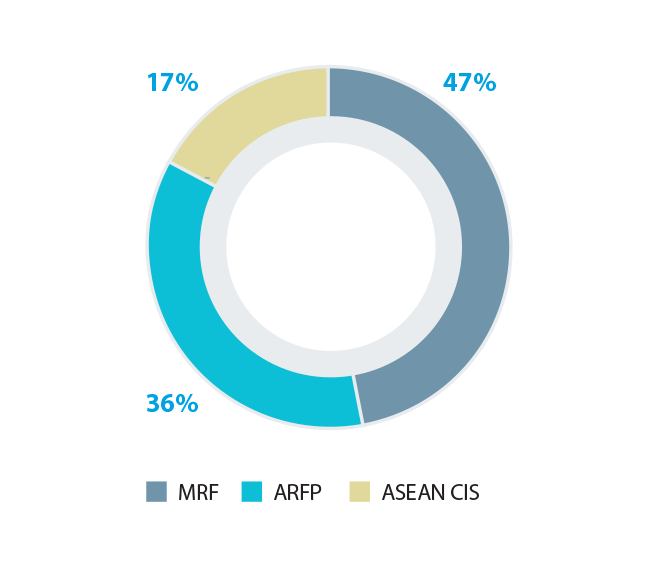

Given the potential size of the China market, it is no surprise that in a survey of asset managers in the region by Asian Investor in July 2016, the largest proportion (47%) picked the MRF as the best platform in the region for business growth, compared to 36% for the ARFP and 17% for the ASEAN CIS.2 Many fund managers are setting up Hong Kong domiciled products in order to establish a track record (and build sufficient AUM) to allow them to participate. However, expectations for the impact of the scheme had diminished year-onyear, as they had for the CIS.

This is perhaps unsurprising since MRF appears to have got off to a relatively slow, and one-sided, start. In the first 11 months of 2016 (the scheme’s first full year of operation) the six Hong Kong funds being sold on the mainland attracted over 10 billion RMB in investment; the 42 mainland funds sold in Hong Kong, by contrast, raised only 136 million RMB.3

Many asset managers of course see the MRF as a work in progress and a relatively long-term play that will take off as more diverse products are cleared for sale in China. But there are still major questions over MRF’s growth trajectory, particularly when other highly anticipated fund schemes (like the Qualified Domestic Limited Partner or QDLP initiative) have been delayed or mothballed by China’s periodic crackdowns on capital outflows.

A QUESTION OF TIMING

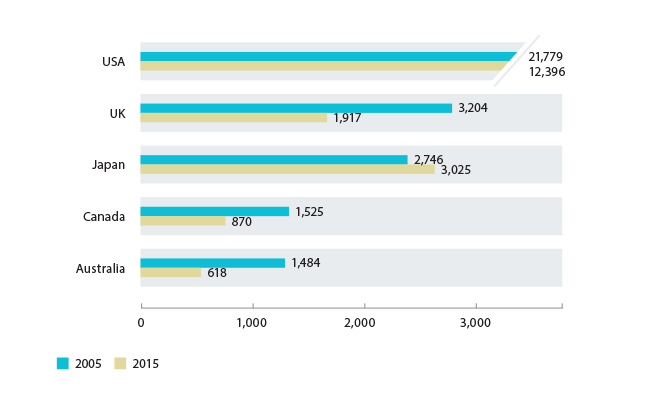

Given the involvement of Japan and Australia, the world’s third and fifth-largest pension markets by assets, the ARFP has generated some excitement, but it is also far from clear how quickly it (or the CIS) will scale. ARFP was originally targeted for implementation in 2016 but this has been pushed back to late 2017.4

Such agreements inevitably contend with wide disparities in regulatory regimes: in the case of the CIS, for example, currency controls in Thailand and Malaysia are seen as major challenges, as are country-specific requirements such as mandated currencies for fund offerings and languages for documentation. ARFP, meanwhile, is dogged by uncertainty around taxation issues, causing Singapore to withhold participation for the time being.

Nonetheless, in the long term regulatory harmonisation and passporting are likely to drive the adoption of more regionally domiciled fund structures. For one thing, it seems unlikely to some market participants that schemes like UCITS will be included in the MRF, since this would preclude China developing its own fund management industry. But in the next three to five years these schemes will be subject to a degree of testing and maturation.

FIGURE 3

Top 5 pension markets by assets (US$bn)

Source: Willis Towers Watson https://www.willistowerswatson.com/en/insights/2016/02/global-pensions-asset-study-2016

Inevitably, given the wide diversity of markets in the region, until passporting regimes are entrenched the regulatory environment will remain complex. Fund managers will need to budget for this. In a recent survey of wealth managers by the consultancy EY, the Asia-Pacific region had the highest percentage of firms citing regulatory compliance as the primary focus of their strategic budgets: 39%, compared with 11% in Europe and just 9% in North America.5

So until harmonisation is a much closer reality, asset managers should be prepared in Asia to spend more time and money dealing with the diversity and complexity of the region’s rules. But as other articles in this series have discussed, Asia’s potential means such long-term strategic investment is likely to pay off.

1. https://www.bbh.com/en-us/insights/ucits-2025--asian-passport-schemes-on-the-rise-/10084

2. http://www.asianinvestor.net/article/confidence-wanes-on-cross-border-schemes/428097

3. http://www.scmp.com/business/companies/article/2062486/expand-number-funds-allowed-be-included-mrf-and-stronger-mainland

4.http://fundspassport.apec.org/2016/12/06/joint-committee-meeting-23-24-november-2016/

5.http://www.ey.com/gl/en/industries/financial-services/asset-management/ey-global-wealth-management-survey-2016-regional-highlights-apac

RELATED INSIGHTS AND RESEARCH

insight

Asian Asset Management: Strategies for Regional Success

Global Asset Managers will need to clearly demonstrate their value to an Asian investor base to stay successful.

insight

Asian Asset Management: Currency Risk Management for Asia Funds

Managing currency risk will become an increasingly vital weapon in the global Asset Management manager’s arsenal.

insight

Asian Asset Management: China - Asia’s Future Asset Management Engine?

The opening of China’s capital markets is the biggest long-term driver of Asset Management activity in Asia.