INSIGHT: MANAGING INTEREST RATE RISK

Considerations For Life Insurers When Rates Are Low

Download the PDF

FOREWORD

Life insurers face continuing challenges in this unprecedented environment of persistently low interest rates worldwide.

Given global interest rates have been on a downward trend for the past 10 years, life insurers face two immediate two challenges:

- A structural challenge predominantly driven by the mismatch between long-dated liabilities versus shorter dated assets. This mismatch tends to be exacerbated in declining interest rate environments, eroding insurers’ economic value of equity as the value of liabilities increases more than the value of shorter dated assets; and

- Reduced investment returns in a low interest rate environment. This is a particular problem for life insurers who have large guaranteed return portfolios.

In markets with recent monetary tightening or the expectation thereof, insurers are concerned with sharp interest rate hikes. Any increase in policy surrenders could potentially result in realised losses due to forced selling of favourable yielding fixed income assets currently held in order to cover surrender benefits.

KEY TAKEAWAYS

- The impact on life insurers across Asia-Pacific tends to be driven by two major factors: the existing insurance liability composition and its sensitivity to interest rates; and, the stage of development of accessible capital markets,

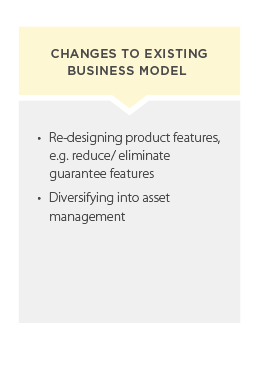

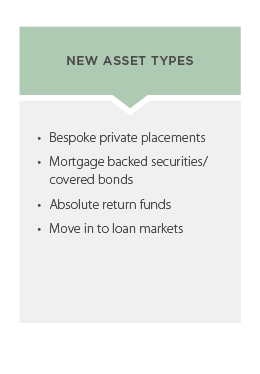

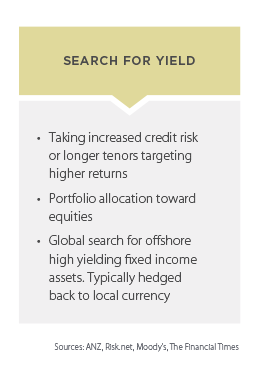

- Life insures should consider a range of solutions including changes to their existing business model, new asset types, extension of asset duration and search for yield.

- Today’s life insurers are able to learn from the Japanese life insurance industry in the 1990s when interest rates fell as low as 3%.

- A challenge in Asia Pacific markets is the limited liquidity in domestic long-dated interest rate instruments, making it difficult for life insurers to hedge meaningful parts of their investment portfolios and address duration gaps.

- Insurers will have to re-think their asset allocation and risk management strategies to cope with the “new normal” of today’s market environment.

- In the long run, insurers are likely to expand asset allocation to alternative assets and loans to overcome the existing duration gap issues.

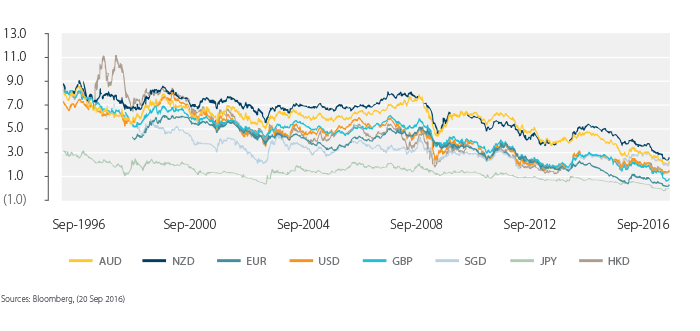

FIGURE 1

Global 10 Year Interest Rate Swap Rates (%)

FIGURE 2

Range of Solutions Considered by Insurers

AUTHORS

Dominique Blanchard, Global Head, Investor Sales, Global Markets, ANZ

Elodie Norman, Head of FIG Hong Kong, ANZ

Mark Lindon, Head of CIG New Zealand, ANZ

For any comments or feedback please contact the authors at GlobalFIGInsights@anz.com

PUBLISHED NOVEMBER 2016

RELATED INSIGHTS

insight

Funds Finance in Asia: The Rise of Capital Call Facilities

The Funds market in Asia is maturing in response to the changing demand dynamics in the region.

insight

Investment Opportunities: Infrastructure Emerges As Its Own Asset Class

Infrastructure is building up the investment portfolios of Pension and Sovereign Wealth Funds.

insight

Currency Risk Management: A Value Lever to Manage Fund Returns

Local assets may generate positive returns, but currency risk can drag overall returns down.

For a full set of relevant disclosures, please visit the link below.

These publications are published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia on its Institutional website.

If you choose to access these materials, you agree that the Website Terms of Use apply. These publications are intended as thought-leadership material. They are not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in these publications is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in these publications constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in these publications is based on information available at the time of publication. While the publications have been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of these publications or the use of information contained in these publications. ANZ does not provide any financial, investment, legal or taxation advice in connection with these publications.

If you are resident or located in the United States of America, you agree that you are not acting on behalf of a natural or individual (including yourself) “U.S. person” (as defined in Regulation S of the U.S. Securities Act of 1933, as amended) and you agree not to transmit or otherwise send any information on this website to any natural or individual person in the USA or to publications with a general circulation in the USA.

If you are resident or located in New Zealand, you are a “wholesale client” under the Financial Advisers Act 2008 (NZ), as amended.

Please confirm that the above statements are correct.