INSIGHT

Sust fin poised for record year in 2021

The year 2021 is expected to be another milestone one for sustainable finance markets as momentum continues apace among investors and issuers mobilising capital to manage climate risk.

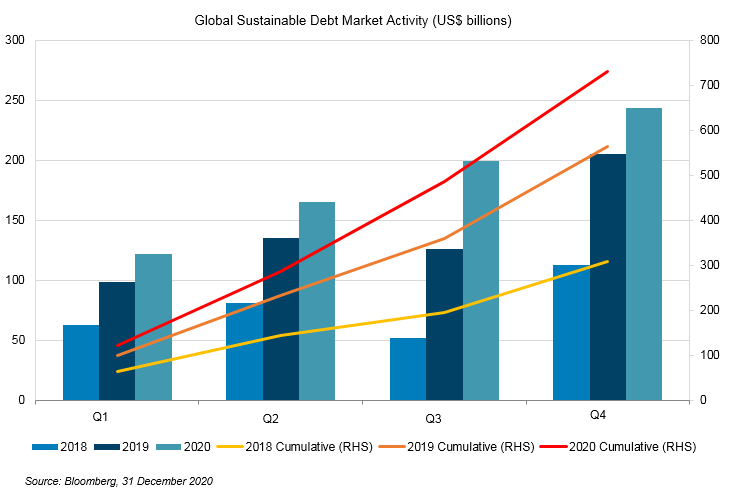

A record 2020 saw issuance for the global sustainable finance market jump 30 per cent to $US730 billion compared to the $US564 billion the previous year, according to Bloomberg New Energy Finance data. The total global sustainable debt market now exceeds $US2.3 trillion, and experts in the market expect that to continue.

“I think the effect of COVID of last year will continue to accelerate these markets,” Katharine Tapley, Head of Sustainable Finance at ANZ said.

“There is increased focus from regulators and investors on the impact of climate change, impacts on biodiversity loss and social issues such as diversity and concerns about inequality in education and health care.”

Momentum in 2021 to date is strong with ESG bond volume topping $US100 billion, a 54 per cent leap compared to the corresponding period last year according to data from Refinitiv.

In New Zealand, a number of initiatives from both government and industry like the Climate Change Commission’s report, the New Zealand Sustainable Finance Forum, the introduction of the Climate Change Response (Zero Carbon) Act and the pending requirement of climate risk disclosure are pushing firms to focus on climate risk.

“[These initiatives] seem to have driven quite a bit of engagement within New Zealand from a lot of companies who have an interest in terms of what that means for them and how they're going to comply,” Dean Spicer, Head of Sustainable Finance – New Zealand at ANZ said.

“Also in terms of being able to look at sustainable financing as an opportunity that comes out of the work they're doing in terms of their overall sustainability strategy and reporting that they're going to be required to do so.”

The Kiwi bond market is already setting new benchmarks and galvanising investors. Auckland Council’s issued a 30-year green bond last September - the longest duration for a New Zealand issuer – which was oversubscribed. ANZ was joint lead manager and green bond co-ordinator.

In transition

Companies and governments alike are focused on their transition strategies to lower their emission targets and working towards a net-zero carbon economy.

“I think transition will continue to be a very strong focus with the proliferation of net zero targets or aspirations by governments, semi governments, large corporations and investors,” Tapley said.

While green bonds are the mainstay of the capital markets, sustainability-linked bonds are expected to be a growth segment for the Asia Pacific market. A sustainability-linked bond commits an issuer to key environmental, social and governance targets and attaches a premium payment mechanism if the targets are not met.

This structure is attractive as it gives a company a lot more flexibility to use the proceeds however it wants as part of its strategy according to Stella Saris Chow, ANZ’s Head of Sustainable Finance – International.

“For companies who don’t have eligible green or have an asset light business model, a sustainability-linked bond gives them the same access to the growing pool of investors with an ESG focus,” she said.

ANZ has led two out of the three sustainability-linked bonds in Asia to date including the region’s first ever with agriculture and commodity firm Olam’s JPY7 billion private offering last December and Singapore-headquartered urban, infrastructure and services consultant Surbana Jurong’s $S250 million 10-year bond, the first public sustainability-linked bond in South-east Asia.

Innovation

More innovative product offerings are in the works to meet borrower financing requirements. These include green and sustainability-linked derivative products such as interest rate swaps, green deposits as well as sustainable supply chain cost structures across a myriad of industries such as the food, beverage and agriculture, manufacturing, telecommunications and technology.

ANZ supported Nestle’s $US50 million sustainable supply chain financing for Nestle’s Nespresso brand, a first in this format in Europe. The financing features an innovative structure to support Rainforest Alliance and similar certified coffee purchases and incentivises sustainable practices among Nestle’s suppliers. Farmers under the Rainforest Alliance undertake best sustainable agriculture practices such as soil and waste management, protection of biodiversity, use of agrochemicals and labour standards.

The global shift to a net-zero carbon economy driven by the development of renewable and storage technologies and aided by the capital markets is unmistakable. This momentum has driven the exponential growth in sustainable finance markets – from what was little more than a niche product to the mainstream in less than a decade.

“When the market first got going, the question within many companies was why would I bother?” Spicer said. “And now they're thinking, well, why wouldn't I do this?”

Sharon Klyne is an Associate Director, Communications at ANZ

This publication is published by Australia and New Zealand Banking Group Limited ABN 11 005 357 522 (“ANZBGL”) in Australia. This publication is intended as thought-leadership material. It is not published with the intention of providing any direct or indirect recommendations relating to any financial product, asset class or trading strategy. The information in this publication is not intended to influence any person to make a decision in relation to a financial product or class of financial products. It is general in nature and does not take account of the circumstances of any individual or class of individuals. Nothing in this publication constitutes a recommendation, solicitation or offer by ANZBGL or its branches or subsidiaries (collectively “ANZ”) to you to acquire a product or service, or an offer by ANZ to provide you with other products or services. All information contained in this publication is based on information available at the time of publication. While this publication has been prepared in good faith, no representation, warranty, assurance or undertaking is or will be made, and no responsibility or liability is or will be accepted by ANZ in relation to the accuracy or completeness of this publication or the use of information contained in this publication. ANZ does not provide any financial, investment, legal or taxation advice in connection with this publication.