RESEARCH

Retail’s newest innovation: deflation

Download the PDF

By Richard Yetsenga, Chief Economist, ANZ | April, 2017

________

The long-trend of commoditisation has re-shaped the dynamics of competition in many markets. Innovations in retail suggest the downward pressure on prices has much further to run and industry deflation will continue. Welcome to Aldi-isation.

The German grocery chain, Aldi, points the way to the future. Despite its lack of frills and glitz, Aldi has a great deal in common with the most cutting-edge developments in eCommerce and digital services.

The most important commonality is the value pricing strategy and its deflationary impact. Beyond being a foreign retailer entering new markets, Aldi’s retail experience strips away many of the things we previously thought were integral to in-store experience.

Aldi-isation: When bricks-and-mortar takes cues from eCommerce

Aldi offers limited product lines of mostly private brands; removes presentational packaging and in-store merchandising; uses boxes and pallets to display stock; and reduces labour costs – at least partly by shifting tasks to the consumer. In effect, Aldi is stripping its product suite back to the core commoditised offering; any effort to differentiate products through presentation or suggestion is dispensed with – leaving lower prices as the only persuasive tool.

This drives radically lower prices, increases competition and pressures margins in whatever market Aldi operates in. In Australia, an April 2016 report from Moody’s warned that Aldi’s expansion in the market is poised to be “credit negative” for the established players because of the ongoing pressure on margins. Moody’s estimated that “Aldi’s lower prices have resulted in Australian supermarket operators reducing prices, resulting in food price deflation of around 1-1.5% annually”. We have noted that “Coles’ average prices have recorded 23 consecutive quarters of deflation”.

In a sense, eCommerce has trained us for such a shift—in buying online, we’ve already accepted the lack of an in-store experience, and we handle everything from selection to checkout ourselves. Aldi is, in effect, blending the bricks & mortar and internet themes.

That is not the only way in which eCommerce has paved the way for this new retail reality: when firms sell online, they make all prices public, dramatically reducing the research costs for competing retailers weighing market entry. This global pricing transparency has also re-shaped consumers’ shopping strategy: PwC’s 2017 Total Retail survey showed that 47% of respondents used Amazon as a research site for prices; while PwC’s 2016 survey found that 31% of respondents used their mobile phone to compare prices while

in-store.

Aldi is not the only retail example of the influence of eCommerce.

In China, Xiaomi is notorious for compressing the margins of major firms like Samsung, Huawei, and Apple, by offering cheap, quality substitutes to competitors’ mobile phones, and doing so without any investment in a traditional retail or advertising presence. (Xiaomi-isation hardly rolls off the tongue though.) This phenomenon of innovative products being commoditised to the point that it eats at the margins of established competitors is becoming increasingly widespread.

Globally, Amazon continues to challenge traditional retailers with offerings such as Amazon Fresh and Amazon Go. Amazon’s founder Jeff Bezos has been quoted as saying “your margin is my opportunity” when undercutting prices in new markets. Amazon’s potential arrival in Australia is likely to increase competitive pressure for local retailers.

In fact Amazon Go takes the Aldi retail experience to a Star Trek-like next step. In Star Trek no one ever pays - you eat, you drink, you leave. Amazon Go seeks to achieve this by using technology to recognise what you put in your basket and charge your Amazon account automatically when you leave. Later this year, Australia will roll out the New Payments Platform (NPP) which will allow for payments to be made in a matter of seconds, 24/7—taking seamless and almost automatic payments a step further. By making the payment part of any transaction virtually instantaneous, NPP could bring new opportunities and have further deflationary impact. The future of payments does actually look to be Star Trek.

THE VIEW FROM ASIA-PACIFIC: EXCEPTIONS TO DEFLATIONARY DOLDRUMS?

One crucial aspect of Aldi-isation is that chains, such as Aldi and Lidl, tend to succeed where costs of living are high. That’s an important point to keep in mind when we try and look at the prospects for Aldi-isation within the Asia-Pacific region, because not only are national economies quite different, but the differences within countries are large as well. Indeed, the radical variation between Chinese cities and regions has been cited as one reason for WalMart’s underperformance in this key market, as the retail giant has struggled to determine a core product mix that can be delivered efficiently on a national scale.

This differential offers a bright spot in a picture that could otherwise easily invoke concern. In some places in Asia, low living costs may mean that Aldi or Xiaomi style models open up new markets among populations which previously weren’t served. Indeed, in China the absence of legacy chains like Walmart has been cited as one reason for the rapid growth of new online retailers. Aldi seems to have recognised this by entering this market not through a brick-and mortar chain but with an online presence on Alibaba’s Tmall online B2C platform. In other words, the benefits of greater consumer choice come at much less disruptive cost to established players.

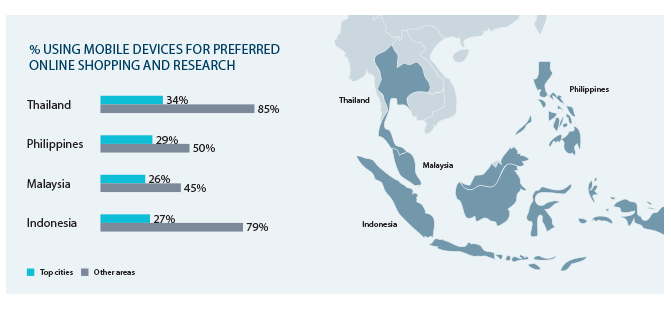

FIGURE 1

Outside the top cities, consumers access digital sales platforms primarily through mobile devices

Source: Bain & Co, Can Southeast Asia Live Up to Its E-commerce Potential? March 2016

Elsewhere in Asia, residents are embracing online shopping via mobile phones. Low-cost retail models may offer them easy and efficient entry to higher consumption. Data from Bain underscores just how significant the difference is between already well-served urban centers and “second-tier cities” and rural areas: In Indonesia for instance, mobile shopping is the preferred eCommerce channel for 79% of rural residents.

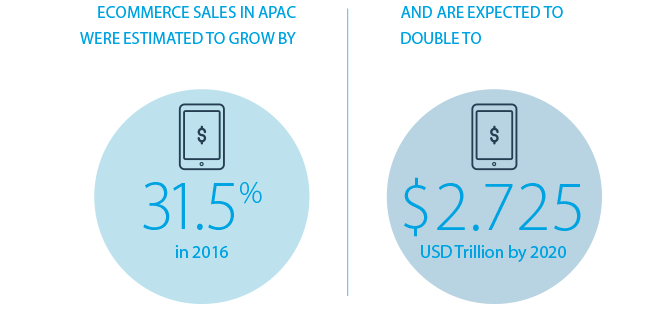

Other data augment the bright picture out of Asia Pacific. PwC’s 2017 Total Retail survey found that over 40% of respondents in Indonesia, Singapore, Thailand and Vietnam buy products at least monthly via mobile/smartphone. In China that rises to 79% of those surveyed. Taken together, this helps explain why APAC online sales are expected to record growth rates well in the double digits over the next five years. Forrester Research, for instance, estimates that approximately 25% of total retail sales will take place online by 2021 in Asia Pacific, with 78% of that coming from mobile.

Indeed, according to eMarketer, APAC will remain the world’s largest retail eCommerce market with sales expected to top USD1trn in 2016 and more than double to USD2.725trn by 2020. The region will also see the fastest rise in retail eCommerce sales, climbing 31.5% this year.

WHAT DOES THIS ALL MEAN FOR DECISION-MAKERS?

This is a trend which resists any one simple narrative. For businesses seeking lessons from the champions of Aldi-isation, the picture is very situation specific. The recent experience of Xiaomi, which now looks to be losing market share in the face of local competition, suggests that low cost does not necessarily guarantee command of the market, though it can certainly change the pricing ecosystem. Indeed, at a TechCrunch Beijing gathering of local startups and founders in late 2015, participants actually recommended avoiding Xiaomi-isation, because many Chinese firms seeking to imitate the company’s success focussed on cost reduction to the exclusion of investing in innovation. That suggests that the stakes for innovation on the cheap are higher than ever, as margins tighten and the need to differentiate remains.

Perhaps the more definite lesson from Aldi-isation is how much of the traditional retail experience consumers are willing to forego in order to save on essentials. This thread underlies everything from Aldi shoppers paying to use a shopping cart to the Star Trek-like invisible checkout of Amazon Go. It’s important to remember, though, from the limited success of the vv model, that customers are looking for value, not just low costs. This also helps us see that this trend still has a way to run, and not just in the markets of Emerging Asia.

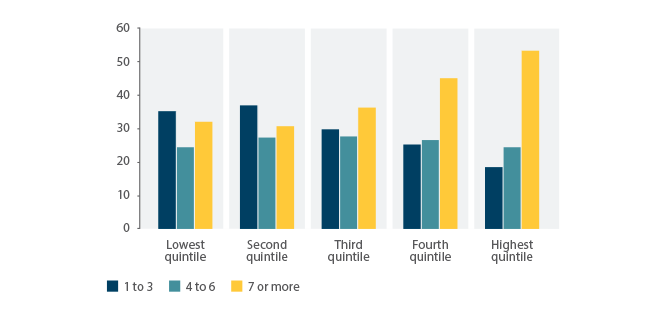

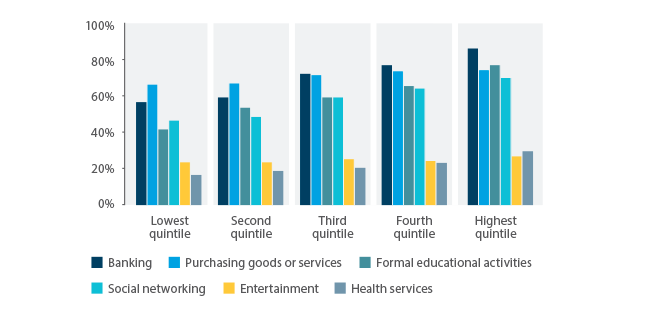

The latest (2015) Household use of information technology data from Australia shows (Figure 3) that while the number of online purchases is still quite low, there is scope across all parts of the income strata to spend more broadly on goods and services on the internet. But putting aside the issue of how many purchases were made, we also see that the use of the internet for online shopping was widespread across the income spectrum (Figure 4).

FIGURE 3

Online transactions made in the last three months - Australia 2015

Source: ABS, ANZ Research

FIGURE 4

Reasons for internet access in last three months - Australia 2015

Source: ABS, ANZ Research

This suggests that the ability to research and compare prices for the best value is widespread, which we know is part of the deflationary effect of eCommerce. Indeed, low numbers of online purchases may mean that shoppers are being choosy, taking advantage of the ability to search and compare items to find the best value. With many eCommerce sites now having social media sharing functionalities built into the site architecture, shoppers are saving items from different online catalogues to compare at a glance and plan purchases. Taken together, this suggests this retail revolution has further to run. For Australia, that next stage is just around the corner— Amazon is poised to enter in July 2017, creating more warnings of eroded margins.

AND OUTCOMES FOR MARKETS

Since mid-2016 markets have priced a global recovery - equity markets and bond yields are higher, and commodity markets have for the most part traded strongly. Activity data generally validate the idea of a recovery, particularly the survey data. The question we have is whether this is just a recovery, or whether it’s reflation as well (ie inflation will return)? We need to work this out now.

Our analysis suggests that headline inflation in the G7 advanced economies is peaking, the prices paid indices in the PMIs are peaking, and the Chinese PPI is peaking. All of these indicators have followed the gains in commodity prices, and % y/y commodity price inflation peaked in the first quarter of 2017.

For the reflation idea to really sustain, there must be some underlying inflation in the system. Aldi-isation suggests it will need to overcome a pretty strong structural headwind. Continued low wage growth in most advanced economies (wage data in emerging markets typically is very poor or patchy), and continued low gains from the finished goods component of the PPI in China, suggest that it’s not coming through yet.

There will be spots of growth or opportunities - in Southeast Asia, for example, Amazon and Alibaba are gearing to fight for market domination, and there are potential opportunities to emerge for shoppers yet to embrace eCommerce in Asia Pacific. But it does suggest that the cutting edge of retail will continue to increase price competition and thus carry a deflationary drag. Which means that the ‘Aldi-isation’ trend is here to stay, at least in the medium term. We are expecting a general global trend to higher interest rates over the next couple of years but Aldi-isation suggests the move will be slow.

RELATED INSIGHTS AND RESEARCH

research

The Paradox of 50/50 Politics

Conventional thinking says a backlash against globalisation is behind the biggest political upsets of 2016—but what if the issue is that the world no longer conforms to our predictive models? By giving voice to those previously without one, social media may have changed things more fundamentally.

insight

No TPP, no problem? Examining Asia’s trade resilience

The politics of anti-globalisation are in the ascendant. US President Donald Trump’s pledges to rip up trade deals and impose border taxes on imports appealed to many voters, as did on the other side of the Atlantic the prospect of the UK’s exit from the EU.

insight

China in 2017: Resilience at home, adversity abroad?

China’s changing economy is robust enough to cope with domestic challenges but a volatile international environment will pose the toughest questions for Beijing’s policymakers.