INSIGHT: Capital Issuance

China's C-ROSS Compliant Regulatory Capital Bonds

Download the PDF

FOREWORD

IN 2015 THE CHINA INSURANCE REGULATORY COMMISSION (CIRC) FINALISED ITS CHINA RISK ORIENTED SOLVENCY SYSTEM (C-ROSS). AT THE SAME TIME, CHINA LIFE’S PERPETUAL NOTE WAS ISSUED UNDER THE NEW STANDARDS. IT MARKED A NEW PRECEDENT FOR FINANCIAL INSTITUTION REGULATORY CAPITAL BONDS IN CHINA.

While bank capital instrument criteria has become more harmonized globally through the Basel III framework, the insurance capital instrument criteria remain highly customised to the domicile of the insurer. This limits the ability of ratings agencies and investors to easily categorise and compare different country insurance capital instruments by tier of capital. Indeed for many insurers it is a minimum criteria for ‘equity credit’ from ratings agencies that drives a more loss-absorbing structure than the country’s prudential supervisor.

Asian insurers have been relatively better capitalised making bond issuance less urgent. However, as they internationalise and compete with global peer groups, regulatory capital instrument issuance as in the case of C-ROSS and China Life may feature more.

KEY TAKEAWAYS

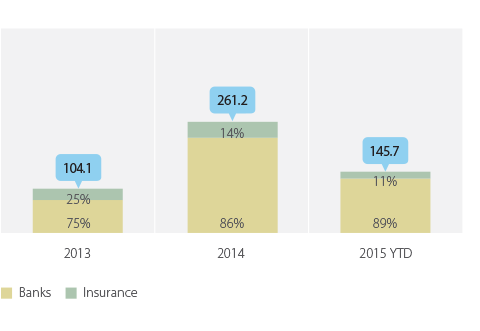

- Investors have ingested billions of dollars in Asian bank capital since 2013. Asian insurance credit is more scarce and C-ROSS bonds could provide a chance to diversify portfolios.

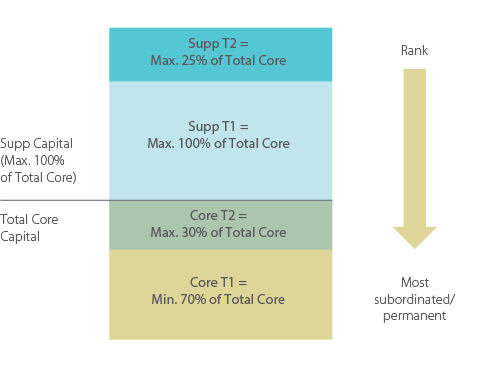

- C-ROSS outlines structural terms for new capital instruments for Chinese insurers, including expected/ minimum requirements. Although China Life’s bond shared many similarities to a Basel III bond there are key differences.

Kang Jae Kim

Global Head, Financial Institutions DCM

Debt Capital Markets, ANZ

Bridget Qi

Head of FIG, China

Financial Institutions Group, ANZ

RELATED INSIGHTS

insight

Balancing Liability & Liquidity: Making Cash Available in Times of Stress

Insurers in Asia face growing pressure to optimise their collateral management.

insight

Clean Energy Investment: Painting Capital Markets Green

Green Bonds are encouraging a broader range of investors to plug the shortfall in Clean Energy investment.

insight

Funds Finance in Asia: The Rise of Capital Call Facilities

The Funds market in Asia is maturing in response to the changing demand dynamics in the region.