INSIGHT

To hedge, or not to hedge: that is the question

中文| English

Download the PDF

Mark Harding, Head of FIG, Southeast Asia, India & Middle East, ANZ |

Rohit Harjani, Director, Rates Investor Sales, ANZ |

Kang Jae Kim, Head of DCM Asia, ANZ |

Jack Tan, Director, Client Insights & Solutions, ANZ |

Martin Whetton, Executive Director and Interest Rate Strategist, ANZ |

May, 2018

________

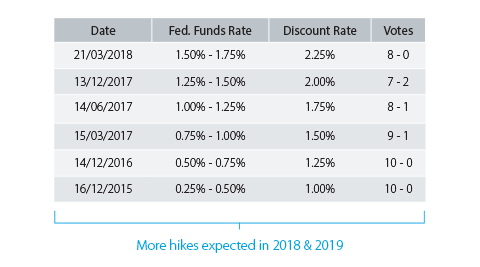

AS QE COMES TO AN END AND INFLATION EXPECTATIONS PICK UP IN THE US, IT’S CLEAR THAT THE WORLD OF PERSISTENTLY LOW USD INTEREST RATES IS DISAPPEARING. THE FED HAS ANNOUNCED SIX HIKES SINCE 2015 AND MORE ARE EXPECTED IN BOTH 2018 AND 2019.

All of which means it’s critical for corporates, banks and asset managers with dollar borrowings to develop a consistent hedging strategy – not only to mitigate the risks of rising USD rates, but also to seize any the arbitrage opportunities introduced by rising rates.

I. GRASPING THE COSTS OF INACTION

The first step in developing any effective hedging strategy is to grasp the costs of doing nothing in the current environment. In other words, borrowers must understand the cost of not hedging.

Of course, this is easier said than done, given the market has become accustomed to years of low – or even negative – rates.

As such, borrowers have let their guard down in recent years, and haven’t had to contemplate hedging the interest rate risk.

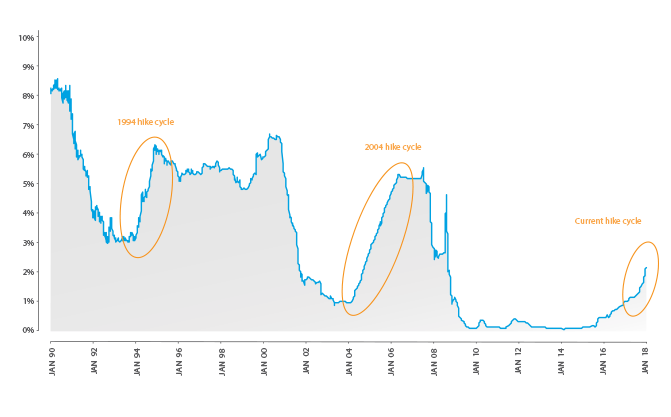

Exacerbating matters is the fact that the current rate hike cycle has been gradual thus far. That’s to say there hasn’t been a sudden shock or significant market event that woke borrowers up and forced them to fall in line.

But all is certainly not lost. While it would have been beneficial to have hedged earlier in the cycle, there is still opportunity to do so now before rates increase further.

IN PERSPECTIVE, THIS RATE HIKE CYCLE HAS BEEN GRADUAL

Borrowers often worry about the costs of negative carry, which can easily evolve into a psychological barrier that inhibits the taking of action. However, negative carry, while persistent, remains low due to flatness in the yield curve as compared to previous rate hike cycles.

Perhaps the best place for borrowers to start is to quantify the costs of inaction in monetary terms and to evaluate whether the risks are substantial enough to warrant an intervention.

II. MATCHING SOLUTIONS TO STRATEGIES

Once a borrower’s desired outcomes are defined, a solution that’s best aligned with the firm’s risk appetite can then be selected, from interest rate swaps, to capped interest rate swaps, to interest rate caps, among many others.

As with most solutions, each has its own benefits and pain points. For example, interest rate swaps protect against increases in underlying floating rates, but on the flipside incur initial negative carry when the fixed rate is higher than the prevailing floating rate. Capped interest rate swaps, on the other hand, only protect up to the cap rate and offer lower initial negative carry.

III. SEIZING CURRENCY ARBITRAGE OPPORTUNITIES

While the risks of rising rates are frequently discussed, an overlooked angle is the number of opportunities that such hikes present.

For example, although US rates are going up, rates in many other markets remain stable. That means that borrowers have the opportunity to fund in other currencies such as EUR or JPY at comparatively cheaper rates than they could in USD.

Across the world, most borrowers tend to rely on two primary currencies for their funding needs: their home market currency and USD. This is has become more pronounced since the financial crisis in 2008-2009, especially in Asia where many companies have taken advantage of low USD rates and used dollar funding for their financing needs.

_________________________________________________________________________________________________________

NOW, THE NEW REALITY OF RISING US RATES IS LIKELY TO PROVIDE AN IMPERATIVE FOR BORROWERS TO CONSIDER ALTERNATIVE CURRENCIES AS A FINANCING SOURCE.

_________________________________________________________________________________________________________

ALTERNATIVE CURRENCIES AS A FINANCING SOURCE

WAYS TO FINANCE IN ALTERNATIVE CURRENCIES

• Raise new financing (loans, bonds) directly in these currencies

• Raise new financing in USD or local currency (due to liquidity or preferential pricing), then swap to the required alternative currency

• Swap existing USD or local currency debt to alternative currency

– Cross Currency Swap (CCS)

WAYS TO OBTAIN OFFSET EXPOSURE (IF NOT CURRENTLY EXISTING)

• Sell or bill buyers in the alternative currency to receive the alternative currency as revenue, cashflow or payables

- In the case where the alternative currency is the local currency for buyers, this may additionally offset any FX risk the buyers have, and provide the opportunity for better pricing

• Apply Net Investment Hedging designation in hedge accounting to offset any alternative currency financing with a subsidiary reporting in the alternative currency

- This allows any FX translation impact of the financing to be recognised in Equity rather than as a gain or loss in the Income Statement

TYPICAL CONSIDERATIONS BORROWERS MUST MAKE WHEN EVALUATING ALTERNATIVE FUNDING CURRENCIES INCLUDE:

• Types of investors in their target market – whether banks, institutional investors, or retail investors, and the differences in each country or region

• Liquidity risks – the availability of financing in a chosen currency (impacting financing costs)

• Cash-flow risks – the potential unavailability of cash to pay interest and repay principal in the financing currency

• Accounting risks – the requirement for debt to be revalued back to the reporting currency and, whether changes in the value of the financing currency will recognised as a gain or loss

Of course, a borrower’s internal company structure can potentially reduce these risks. For example, operating a subsidiary that reports in the financing currency can offset the accounting risk, while earning significant revenue in the financing currency can reduce the cash-flow risk.

For borrowers who require the borrowings to be in USD, there could even be short term arbitrage opportunities to finance in other currencies then swap back to USD at a lower all-in cost.

Regardless of how a borrower decides to hedge, however, the hard truth is that US rates will continue to push higher in 2018 and 2019. The era of benign rates is well and truly over and credit spreads are widening. Given the potentially high cost of inaction, it’s high time for borrowers to manage the risks – while they also evaluate the opportunities offered by alternative currencies.

RELATED INSIGHTS AND RESEARCH

insight

ASX Listed Investment Vehicles Are Changing Fast

While listed investment vehicles (LIVs) have been around for a long time, 2017 was a watershed year in IPOs... The size of these LIV raisings have led to evaluated interest in the sector by a range of local, regional and global players.

insight

Why It's High Time to Dip into Asia's RegS Liquidity Pool

Rising middle class wealth in Asia has triggered a revaluation of global credit among Asian investors, especially the offshore US dollar bond market. This revaluation has created a deep pool of liquidity across the world's most dynamic region for both issuers and investors.

insight

Are Pan-Asian Corporates Missing the Formosa Opportunity?

In recent years, Taiwan’s ‘Formosa’ bond market – which refers to bonds issued in Taiwan but denominated in currencies other than the New Taiwan dollar – has emerged as a leading offshore fundraising destination. But are pan-Asian corporates taking advantage of the opportunity it presents?